Spread can also refer to the difference in a trading position – the gap between a short position (that is, selling) in one futures contract or currency and a long position (that is, buying) in another. This is officially known as a spread trade. In underwriting, the spread can mean the difference between the amount paid to the issuer of a security and the price paid by the investor for that security—that is, the cost an underwriter pays to buy an issue, compared to the price at which the underwriter sells it to the public. In lending, the spread can also refer to the price a borrower pays above a benchmark yield to get a loan. If the prime interest rate is 3%, for example, and a borrower gets a mortgage charging a 5% rate, the spread is 2%. The bid-ask spread is also known as the bid-offer spread and buy-sell. This sort of asset spread is influenced by a number of factors:

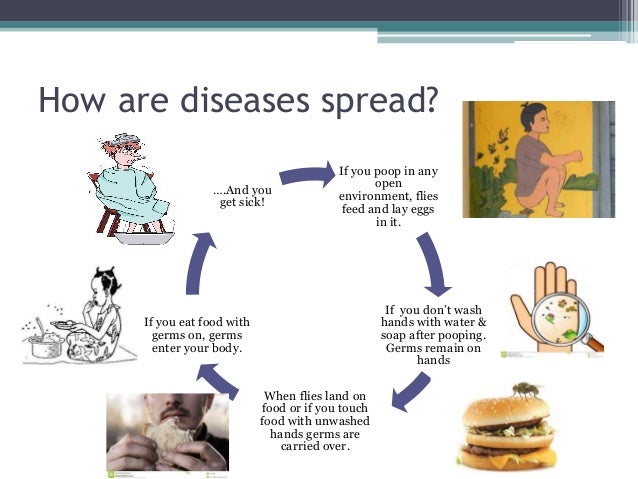

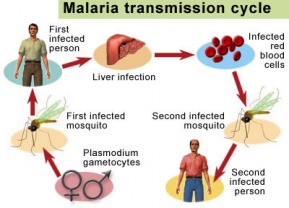

Immediate cause: The organisms that enter our body and causes disease is called immediate cause. For example, virus, bacteria, protozoa etc. surroundings, contaminated food, improper nourishment, poverty, poor standard of living etc. Diseases may be due to infectious and non-infectious causes..

/infection-5096014-Final-eaf7a90b39fd4eb69b3a1776b721d975.gif)

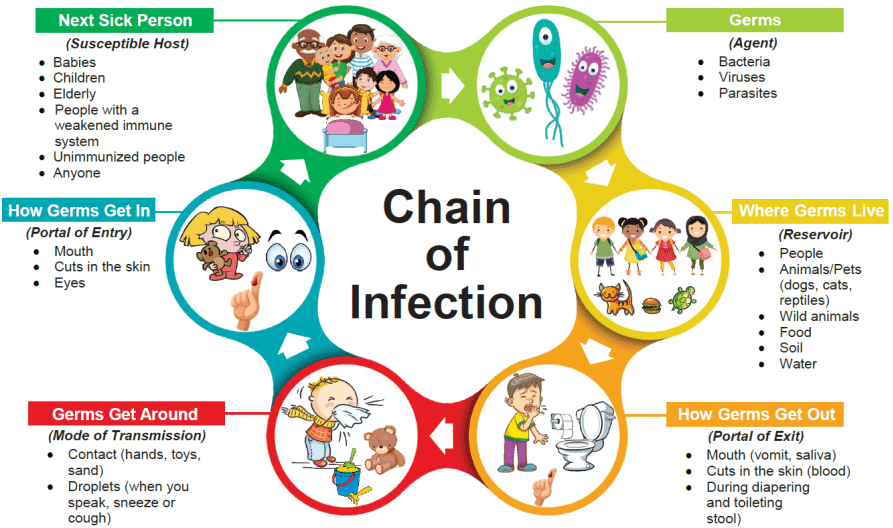

Infectious diseases are disorders caused by organisms — such as bacteria, viruses, fungi or parasites. Many organisms live in and on our bodies. They're normally harmless or even helpful. But under certain conditions, some organisms may cause disease.

Many studies are done on the causes of the spread of infectious disease, and their conclusion has been due to the transfer of germs, bacteria or viruses from one person to another. All the studies come down to the fact that proper hand washing technique can prevent the spread of those diseases.......